LONDON / NEW YORK: Global banks including Citigroup Inc, JPMorgan Chase & Co and Société Générale are putting pressure on them to remain a depository bank in Russia because rivals and funds fear they could lose services critical to future investment in the country.

Traders, bankers and executives from three other financial institutions have told Reuters they have sought or sought on behalf of clients reassurances about any bank’s long-term plans for these businesses, which will clear, regulate and protect billions of dollars of Russian owners.

Custody banks have departments that manage assets for customers in exchange for fees.

A London-based bank source, who spoke anonymously to respect the confidentiality of her large global fund client, said she was in weekly contact with seniors at Citibank Moscow about the status of their depository business.

The source said that their client was waiting to trade Russian shares when the Moscow Exchange (MOEX) reopened, but they needed reassurance to have a Western depot in place.

According to the source, Citigroup executives said they will serve clients as long as sanctions are allowed.

A source with knowledge about Citi said that large US and international businesses in Moscow using this bank and cutting off these customers would damage customer relationships. Other bankers say it is crucial for the industry that Citi, a key player, continues to operate in Moscow.

Citigroup declined to comment.

A second New York-based banker said he had sought assurances from SocGen that they would “stay on the ground” so that his bank could meet its customer care obligations. Executives at SocGen have provided assurances that they will at least in the short term, the source said.

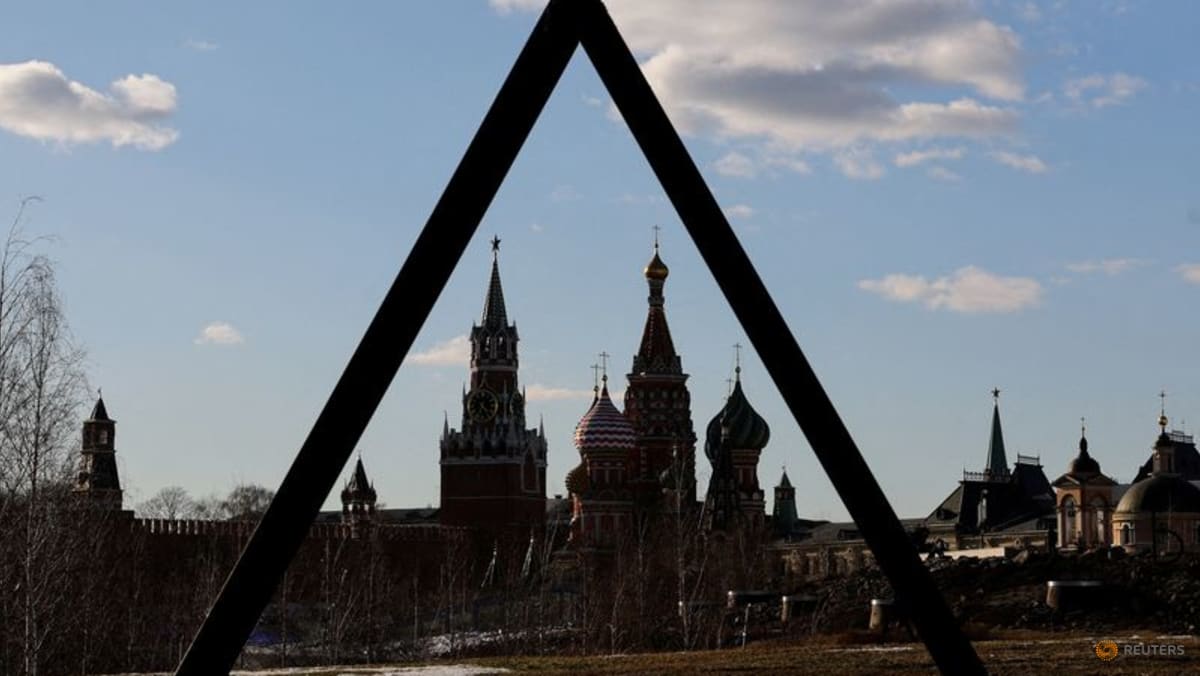

Citigroup and SocGen, Rosbank’s French parent, have already announced plans to dramatically cut back on operations in Moscow as part of a comprehensive program of Western sanctions to isolate Russia economically following its invasion of Ukraine.

Both banks have said they will help their clients with the complex tasks of relaxing or reducing Russia’s exposures, and said the withdrawals take time to execute.

But neither has made a public statement about the long-term status of their depository services, leaving some customers nervous about the future.

In an email statement, a spokeswoman for SocGen said the group “conducts its business in Russia with the utmost caution and selectivity while supporting its historic clients.”

SocGen “strictly adheres to all applicable laws and regulations and is diligent in implementing the necessary measures to implement strict international sanctions as soon as they are made public.”

The bank declined to comment specifically on its depository business in Russia.

JPMorgan Chase & Co. also provides similar depot services from its Moscow outpost. The bank has received requests from customers seeking assurances that the care services will continue to be provided, according to a source familiar with the matter. It has previously said it will continue to act as a depot for its customers.

Bank of New York Mellon Corp. also said it continues to offer depository services in Russia.

SHUT UP

When banks decide to mothball their deposit services in Moscow, many Western investors who already hold Russian stocks or bonds would have to look elsewhere for a bank to hold these assets, while others would like to exploit a financial market or economic rally when sanctions be lifted. it is more difficult to follow these plans.

SocGen, France’s third-largest bank, warned stakeholders on March 3 that in a “potentially extreme scenario” its ownership rights to its business in Russia could be revoked.

Citi, meanwhile, initially said it would operate its Russian business on a more “limited basis” during the war, which President Vladimir Putin called “a special military operation.”

But by March 14, it said it would accelerate and expand the scope of that retreat by abandoning its institutional and wealth management clients in Russia.

In addition to transaction services, many of the Moscow-based detention teams provide add-ons such as language translation of central bank documents, which are also highly valued by Western clients, the source said.

Russia’s central bank has said in a statement that it would resume trading on Thursday, with 33 securities being traded for a limited time on the Moscow exchange and being banned from short selling.

The challenge for banks to maintain commitments to customers in Russia is becoming increasingly fierce, and could become even more frightening if sanctions are tightened, with the anniversary of a month of invasion this week.

Russia has laid down strictly new rules for foreigners seeking permission to buy and sell Russian assets, ranging from securities to real estate.

Another New York-based banker described the deal to ensure customers respected securities sanctions as a “logistical nightmare” and said his company had hired 20 new compliance staff in recent weeks.

Global companies, banks and investors have so far revealed nearly $ 135 billion in taxes to Russia, the company said in a statement.

U.S. asset managers including Vanguard and Capital Group Companies Inc., which manages the American Funds franchise popular with millions of moms and pop pension savers, have also revealed huge burdens that will increase billions of dollars, according to recent portfolio information available.

(Report from Sinead Cruise in London, and Matt Scuffham and Megan Davies in New York Additional Reporting by Paritosh Bansal in New York Editing by Matthew Lewis)

Add Comment